Commonly called bond funds fixed income funds are simply mutual funds that own fixed income securities such as US Treasuries corporate bonds municipal bonds etc. DWS Total Return Bond Fund.

Investors Flee Stocks And Bonds Pile Into Cash Fund Flow Data Show Marketwatch

Investors Flee Stocks And Bonds Pile Into Cash Fund Flow Data Show Marketwatch

20 rows Tax efficient.

Taxable fixed income funds. Treasury-Inflation Protected Securities TIPS Fixed Income Funds. DWS Short Duration Fund. Fixed-income funds that distribute income that is subject to taxation at the federal state and sometimes local levels.

The Best Taxable-Bond Funds. Devereux was a partner at Goldman Sachs where she spent over 20 years in mortgage-backed securities and structured product trading and sales. Effective April 18 2016 the Fund ceased trading as a closed-end fund and began operations as an open-end fund on April 25 2016.

Income funds are tax efficient than fixed deposits especially for. Taxation on Fixed Income Investments. Active fixed income investing that focuses on preservation of capital and income generation for taxable and tax-exempt investors.

DWS Floating Rate Fund. Lets start with five basic types of fixed income funds. A taxable bond is a debt security ie a bond whose return to the investor is subject to taxes at the local state or federal level or some combination thereof.

The taxes imposed on Fixed Income Investments are as follows-For long term capital gains the tax on fixed income funds with indexation is 20 and without indexation is 10. Whether your goal is to diversify your portfolio help protect your investments from stock market volatility or generate current income Schwabs professionally managed bond funds can offer easy and straightforward fixed income solutions. Some Vanguard fixed-income funds have consistently outperformed their benchmarks and provide multiple benefits to investors with their low fees and.

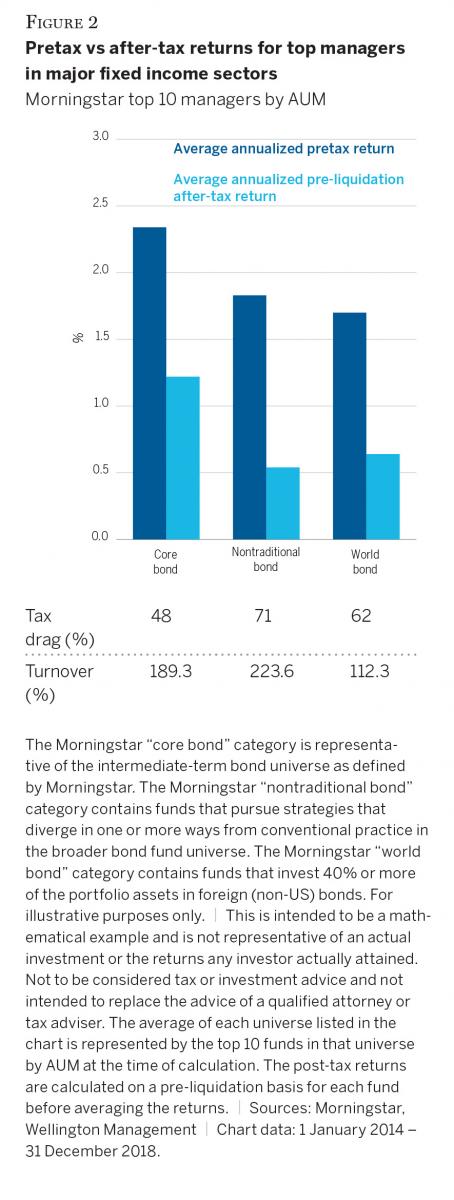

VWITX invests in high-quality municipal bonds which are tax-exempt at the federal level. A fixed-income investment involves an issuer or a borrower making payments to a lender or investor at a set date for a set amount. 17 trillion in taxable fixed income assets are concentrated in just four Morningstar categories.

Here are the highest-rated mutual funds and ETFs across a series of Morningstars taxable fixed-income categories. Vanguard Intermediate-Term Tax-Exempt Fund VWITX. Guggenheim Investments Ranked as Barrons Best Taxable Fixed-Income Fund Family Santa Monica CA Guggenheim Investments the global asset management and Investment advisory business of Guggenheim Partners has been ranked as Barrons top taxable fixed-income mutual fund family of 2020 out of 53 companies.

Treasuries assume a 38 ACA tax for the 32 and above brackets. Calculate the taxable equivalent yield by dividing the tax-free yield by 1 minus your marginal income tax bracket. DWS High Income Fund.

Devereux has oversight responsibility for investment activities within the rates-related sectors of the taxable fixed income market including foreign exchange. An investor trying to decide. Take advantage of competitively priced funds that.

Intermediate Core-Plus Bond Short-Term Bond High Yield Bond and World Bond. DWS Global High Income Fund. For example if you are in the federal 28 percent tax bracket a 3 percent.

Corporates and taxable munis assume an additional 5 state income tax and 38 ACA tax for the 32 and above brackets. The income-generating nature of bond funds can produce unwanted taxes in a taxable account but bond funds like VWITX can be a smart move for investors with taxable accounts. Fundamental credit research and macroeconomic strategy form the basis of our investment process and risk management the essential element of portfolio management.

While the investment guidelines of the open-end fund are similar to the guidelines of the closed-end fund a closed-end fund does not have to manage to liquidity in the same fashion as an open-end fund and the closed-end fund had the ability for greater leverage. DWS Emerging Markets Fixed Income Fund. Prior to joining the firm Ms.

Apart from these Debt Funds also offer better returns than Money Market Funds in the long run. These fixed income funds come in many shapes and styles. In the current low interest rate environment most financial.

Difference in yields may be due to index characteristics such as duration maturity or credit quality.

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Fixed Income Needn T Be So Taxing Campden Fb

Fixed Income Needn T Be So Taxing Campden Fb

/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png) Benefits Of Investing In Municipal Bonds For Income

Benefits Of Investing In Municipal Bonds For Income

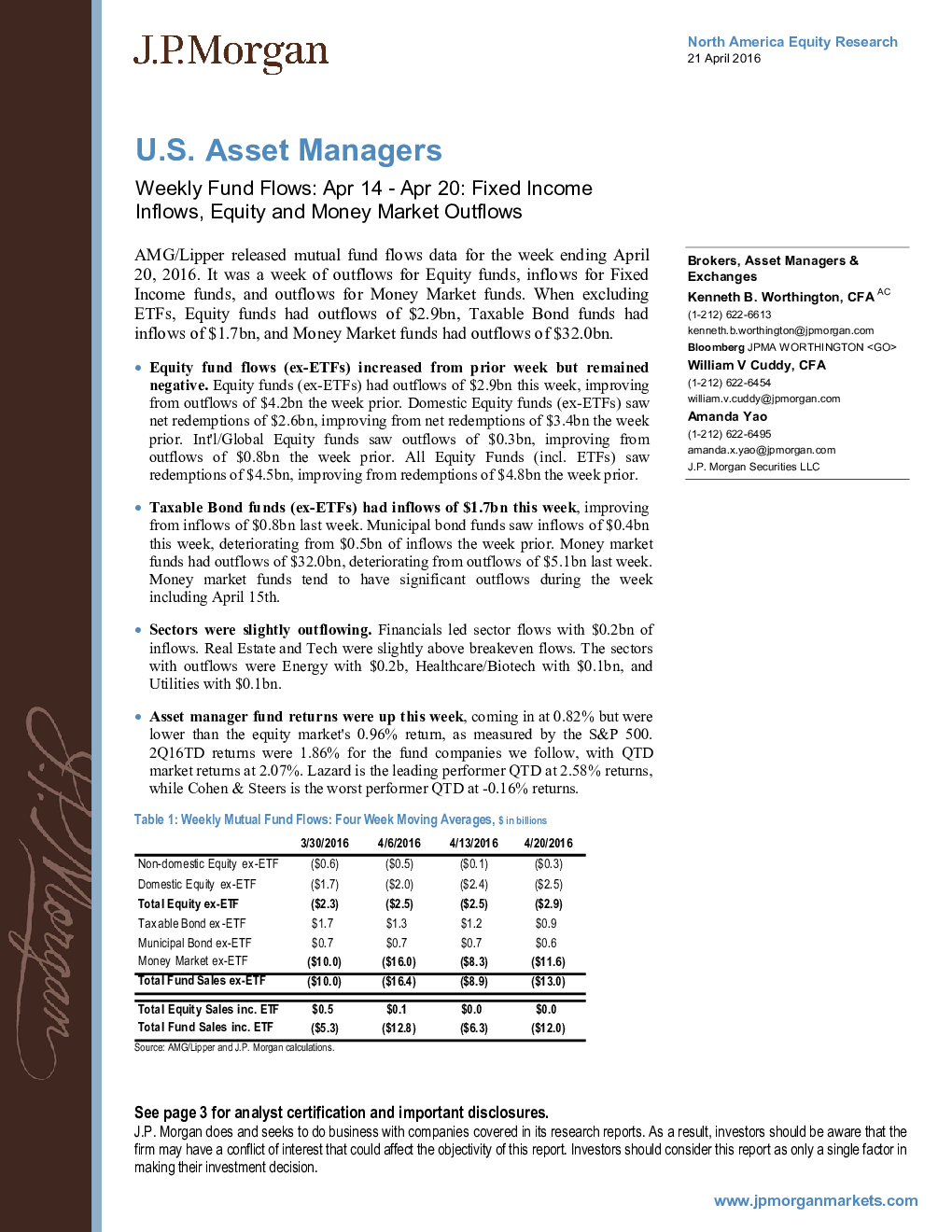

U S Asset Managers Weekly Fund Flows Feb 25 Mar 2 Fixed Income And Money Market Fund Inflows Equity Outflows 发现报告

U S Asset Managers Weekly Fund Flows Feb 25 Mar 2 Fixed Income And Money Market Fund Inflows Equity Outflows 发现报告

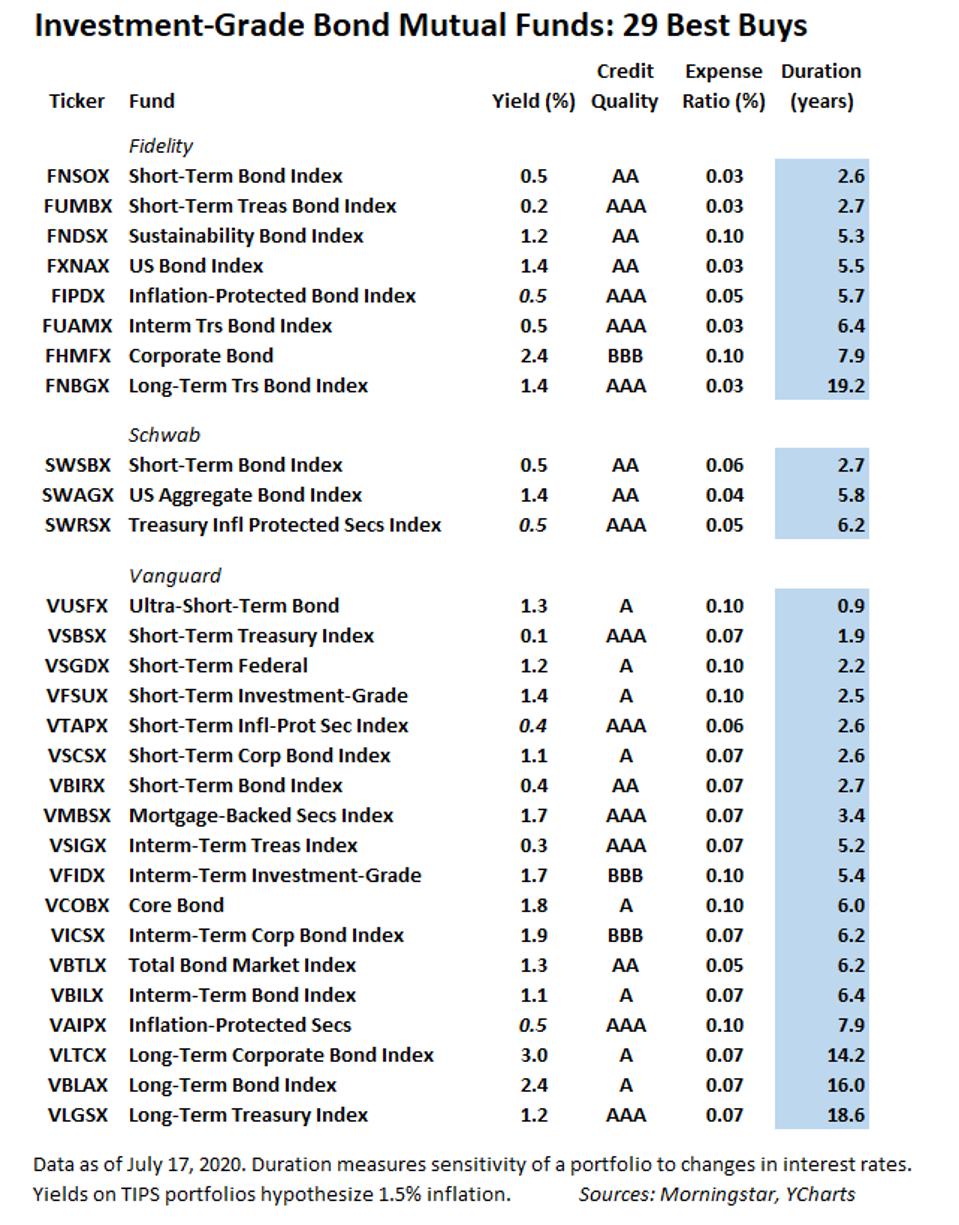

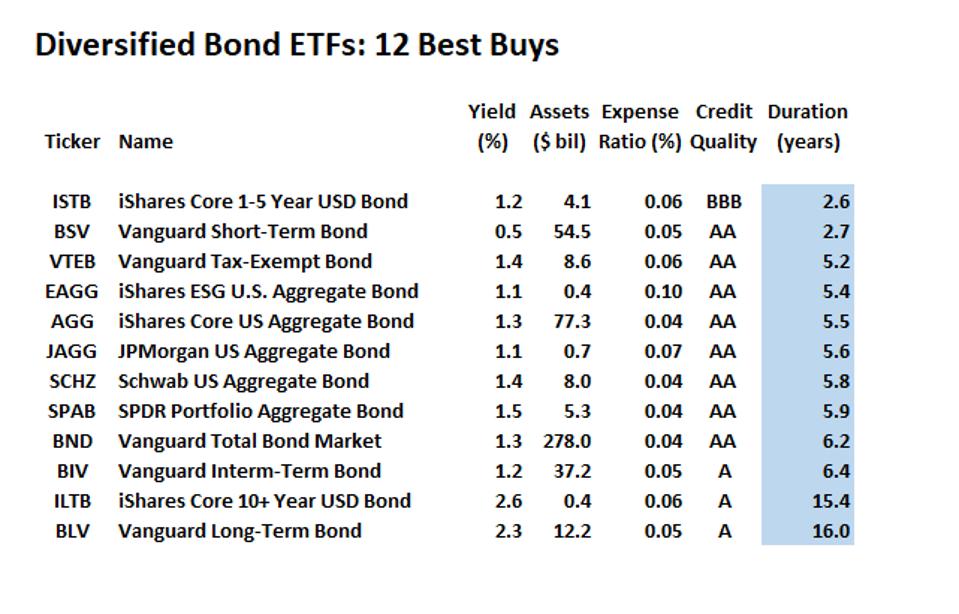

Guide To Investment Grade Bond Funds Best Buys

Guide To Investment Grade Bond Funds Best Buys

Guide To Investment Grade Bond Funds Best Buys

Guide To Investment Grade Bond Funds Best Buys

Tax Tweak Disrupts Bond Markets

Tax Tweak Disrupts Bond Markets

10 Best Performing Corporate Bond Mutual Funds 2021 Fincash Com

10 Best Performing Corporate Bond Mutual Funds 2021 Fincash Com

Best Mutual Funds Awards Best U S Taxable Bond Funds Investor S Business Daily

Best Mutual Funds Awards Best U S Taxable Bond Funds Investor S Business Daily

Demand For Taxable Bond Funds Continues To Grow

Demand For Taxable Bond Funds Continues To Grow

The Best Taxable Bond Funds Morningstar

The Best Taxable Bond Funds Morningstar

Short Term Taxable Fixed Income Managed Accounts Blackrock

Short Term Taxable Fixed Income Managed Accounts Blackrock

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.